Revising Your Savings Strategy: Practical Steps for a Stronger Financial Future

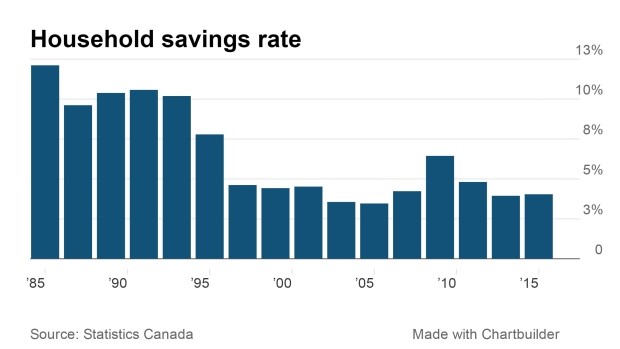

There’s no easy way to say it. Saving money starts with shifts in behavior. I speak from experience. The rewards, however small, help fuel the momentum of that shift. But, you have to start somewhere. CBC News conducted research, which shows that the rate of savings in Canada since 1985 had dropped from almost 13 percent annually to around 4 percent.

Since 1985, annual savings in Canada has dropped from 13% to 4%

Rising debt makes it harder to save. Where are the savings in a life filled with car payments, insurance, credit card debt and loans, rising rents…I’m exhausted just writing the list. I had to take a time-out and, as much as it pained me, look at all of things I spend money on. The hard choices began. In a few months, though, I started turning things around. So, for better or worse, here’s the “nickel and dime” list that led me to savings.

- I always use my cell phone. I never used my home phone. Home phone gone. I ensured I had the best plan on my cell, scrutinizing data usage, free minuted and long distance. I was able to slice my monthly phone bill by over 30 percent.

- Three hundred channels of cable. REALLY? I watch about 20 channels, if that. I revisited my cable package and sliced it down as much as possible. I replaced movie channels with Netflix at around 10 dollars a month. I reduced my cable bill by half.

- I don’t shop for groceries when I ‘m hungry. I actually watch for specials in flyers and use my freezer more effectively and stock it with frozen food like chicken and vegetables that I can buy in family sized packages. I realize that some health and nutrition nuts will gack—-yes “gack” — however, I do buy fresh as well. I reduced my grocery bill by over 30 percent.

- I stopped eating out as much as possible. There were months I spent twice as much what I spent on groceries. Need I say more?

- Suck it up and visit thrift stores or clearance type retailers (like Winners). It is amazing what you will find in terms of quality. At the end of the day …. how many shirts, skirts, tops, socks and coats do you really need?

- Look for every opportunity to reduce bill amounts from utility companies. Find financial institutions that offer lover or no fees and may even contribute to your savings. Cashco Financial’s Mom Match Savings Account matches monthly savings of up to 10 dollars every months. Make the effort to understand the bills that most of us tend to pay and file without much scrutiny. After all, there are other utility companies to choose from as well as financial institutions.

- Consider a consolidation loan to right your financial rudder. Doesn’t have to be a large amount; just enough to reduce the size of monthly payments. Makes a world of difference.

Cashco Financial’s Mom Match Savings Account matches monthly savings of up to 10 dollars every month.

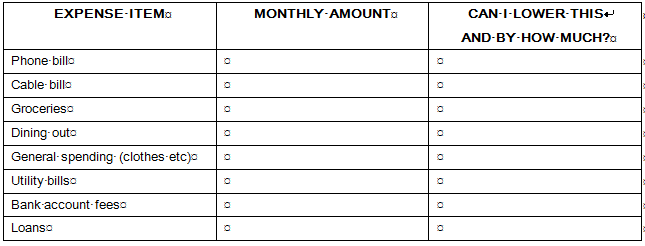

It’s human nature to look at one thing and, if it doesn’t appear substantial, we ignore it. That perception can only be shifted of we make the effort to add up several aspects of our reality. So, read this checklist. Fill it out. See how much you might be able to save.