How To Start Investing: A Beginner’s Guide

As the relationship between Cashco Financial and ATB Financial continues to evolve, both companies pursue the development of resources and investments education to help people with their finances. ATB offers many information resources about investing through ATB Prosper.

Both companies cover several investment topics:

- Paying down debt

- Building savings

- Retirement plans

- Education plans

- Major purchases

When it comes to investing, both companies advocate key, principle, investment strategies such as developing effective saving habits, understanding returns on investment, leveraging key tactics such as pre-authorized contributions, following a consistent plan, and maintaining steady growth. It takes a little discipline and the rewards are realizable. It helps individuals create certainty in their financial life, and the earlier in life a plan can be started, the greater the rewards down the road.

Effective investing requires a consistent long-term investment plan.

Here’s a guide for first time investors who are looking for some of the tactics that make for a solid investment strategy and investment plan. By the way, this is not a guide to buying and selling stocks or bonds.

SETTING AN INVESTMENT GOAL!

As previously mentioned,the main areas of investment focus are debt, general savings, retirement, major purchases and education. The more you know about your goal, such as which education institution or program you are interested in, the purchase you want to make, or what kind of retirement situation you see yourself in, the better your plan will develop.

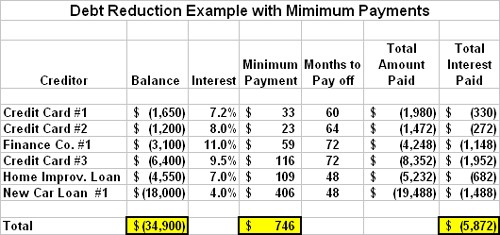

When it comes to debt, list all the debts and interest fees and the payments you are currently making. The total may be intimidating, but, remember, it’s simply a number and the goal is to shrink the number and reduce the pain while you deal with it.

When it comes to a retirement plan, list the anticipated costs and ongoing expenses you will face. Consider two scenarios: the minimum lifestyle you are willing to accept as well as your most realistic version of the best scenario. The same applies to any major purchase. List options and the related costs. Perhaps the least painful investment plan is a general saving plan. It’s all about determining how much you can set aside regularly and letting that be enough to motivate you. The ongoing number (monthly savings) will reveal itself.

Setting a goal means doing the research and capturing your present reality on paper.

BUILDING THE PLAN

The first step is to assess the institutions and the financial instruments you are currently using. This includes the bank you use, the accounts you hold, the credit card you use, and the loans and other debt you are paying down. How much are you paying in fees and interests? How much principle do you have left to pay and how much are you reducing it on a monthly and yearly basis. The fact remains, debt is a time capsule and you need to know how long you might be in that capsule based on what your current levels of payments are.

The next step is to compare institutions and financial instruments to see if there are better options. Can you eliminate fees? Is consolidation a possibility? Who offers the best interest rate to help you build savings for your future?

At this stage, you may want to engage an accountant or some kind of qualified financial planner. It doesn’t have to be a certified accountant and the consulting service does not have to be expensive. There are many services out there who offer a decent service at a reasonable rate. Make the effort to find them and compare.

Draft the plan and, at every step, ask yourself the question: am I able to meet that target month after month? Be prepared to eliminate anything you can’t handle. It’s okay to start small.

Comparing resources leads to a better investment plan.

MONITOR YOUR PROGRESS

As simple as it sounds, it’s the one thing most people do not do. Ask yourself, do you look at your monthly bank statement regularly? Be honest. Are you prepared to look at it every month? It is fruitless to say to someone, you have to be disciplined to get started. But, it’s true. So either you will or you won’t. But one thing is certain. When you begin to see the results little by little, it will become addictive.

As simple as it sounds, it’s the one thing most people do not do. Ask yourself, do you look at your monthly bank statement regularly? Be honest. Are you prepared to look at it every month? It is fruitless to say to someone, you have to be disciplined to get started. But, it’s true. So either you will or you won’t. But one thing is certain. When you begin to see the results little by little, it will become addictive.

To reinforce this, compare your progress to previous history. The difference you see will be a compelling reminder. In fact, the original meaning of the word “discipline” was “to remmeber what is important”. Sometimes, remembering something that used to be less important and cost you much more than you care too…remember….can fuel your motivation.